By Michael Storts

V.P. of Finance & Administration, Lessiter Media

mstorts@lessitermedia.com

262-777-2433

In the realm of business, understanding the distinction between cash flow and profit is crucial for the sustainability and growth of a company. While both are vital, they represent different aspects of a company's financial health. This week's Marketing Minute delves into the definitions, differences, and the significance of cash flow and profit, providing a clear understanding of why managing both effectively is essential.

Defining Profit and Cash Flow

Profit is an accounting concept that measures the difference between recognized income and expenses. It's straightforward: if a company earns more than it spends, it records a profit. On the other hand, cash flow refers to the movement of cash into and out of the business. It includes all cash transactions, not just those related to sales and expenses, but also aspects like depreciation, prepaid expenses, receivables, interest payments, and invoicing timing.

The Importance of Cash Flow and Profit

While profit is an important indicator of a company’s financial performance, cash flow is crucial for day-to-day operations. The two concepts, although seemingly similar, have distinct impacts on a business. For instance, a company can be profitable but face cash flow issues, hindering its ability to pay suppliers and employees. Conversely, a company might show a loss but maintain positive cash flow, allowing it to sustain operations and avoid insolvency.

Illustrating the Difference: A Simple Example

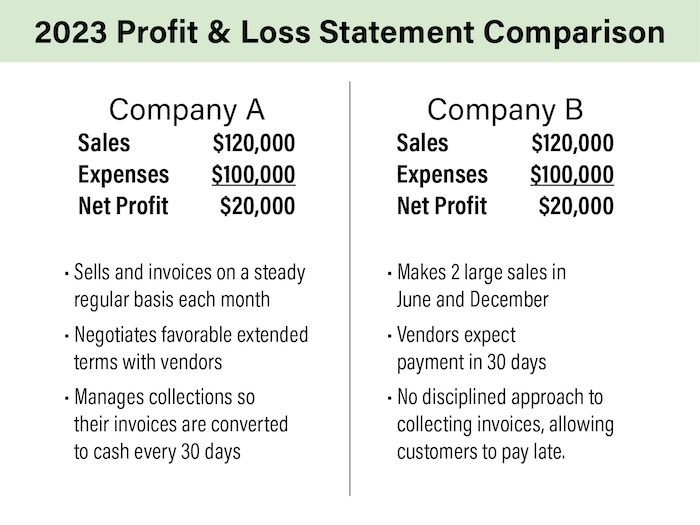

Consider two companies, both showing the same annual profit of $20,000 from $120,000 in sales and $100,000 in expenses.

Company A: This company spreads its sales evenly throughout the year, receiving $10,000 monthly. It negotiates favorable terms with vendors, extending payment terms to 60 or 90 days, and manages its collections efficiently, converting invoices to cash within 30 days.

Company B: This company makes two large sales of $60,000 each in June and December. It does not negotiate with vendors, paying bills within 30 days or sooner, and lacks discipline in collections, allowing customers to pay late.

Company B: This company makes two large sales of $60,000 each in June and December. It does not negotiate with vendors, paying bills within 30 days or sooner, and lacks discipline in collections, allowing customers to pay late.

Ensuring Financial Health

Active management of cash flow is essential. If a business cannot pay its vendors or employees, it faces severe operational disruptions and potentially will go bankrupt as a result. Maintaining positive cash flow is often more critical than merely showing a profit. Even for a company that is currently in good shape, it's crucial to continuously monitor and manage cash flow alongside profit.

Understanding and managing both cash flow and profit are vital for the longevity and success of any business. By recognizing their differences and the unique roles they play, companies can ensure they meet short-term obligations and sustain long-term growth.

For further clarification or questions, feel free to reach out. Let's continue to work together for a prosperous year!